Introduction

The US economy has been a subject of intense debate, with some hailing it as a beacon of economic exceptionalism and others warning of an overhyped bubble ready to burst. This article delves into the recent economic performance, key indicators, and expert opinions to provide a balanced view on whether the US economy is indeed exceptional or if it is facing significant risks.

Recent Economic Performance

The US economy has demonstrated remarkable resilience and growth in recent years. According to S&P Global Ratings, the US GDP is expected to expand by 2.7% in 2024 and 1.8% in 2025, outpacing many other developed economies.

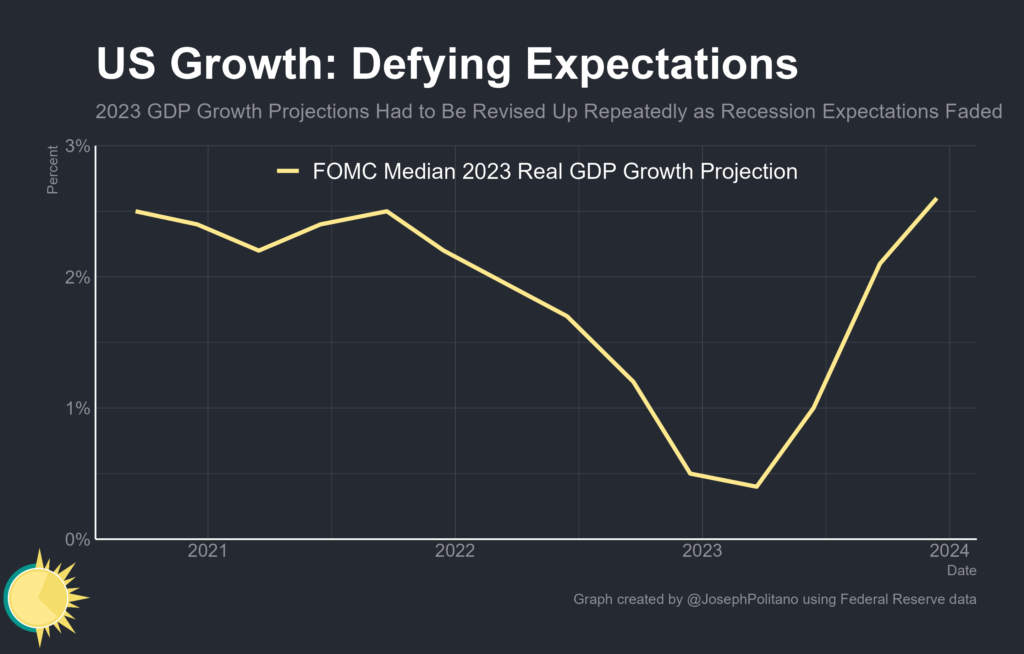

GDP Growth and Projections

Real GDP growth for the US has been robust, with a 2.7% annual growth rate predicted for 2024 by both S&P Global Ratings and Deloitte. This growth is driven by strong consumer spending, business investment, and government expenditures. For instance, Deloitte forecasts that consumer spending will rise by 2.4% in 2024, slightly more than the 2.2% increase recorded in the previous year.

Consumer Spending

Consumer spending remains a cornerstone of the US economy, accounting for roughly 80% of growth in the first three quarters of 2024. JPMorgan notes that inflation-adjusted consumer spending grew 3.0% year-over-year in the third quarter, fueled by strong gains in real after-tax income.

Business Investment

Business investment is another significant driver of economic growth. Deloitte predicts that business investment will rise 4.2% in 2024, driven by investments in software, intellectual property, and other digital technologies. The Inflation Reduction Act and the CHIPS Act are expected to continue driving strong gains in structures and machinery and equipment investments.

Productivity and Innovation

The US has seen a notable boost in productivity, outstripping most advanced economies. Since the 2008-09 financial crisis, US labor productivity has grown by 30%, more than three times the pace in the Eurozone and the UK. This productivity boom, coupled with pioneering roles in tech innovation, has been a key factor in the US economic success.

Challenges and Risks

Despite the positive outlook, there are several challenges and risks that the US economy faces.

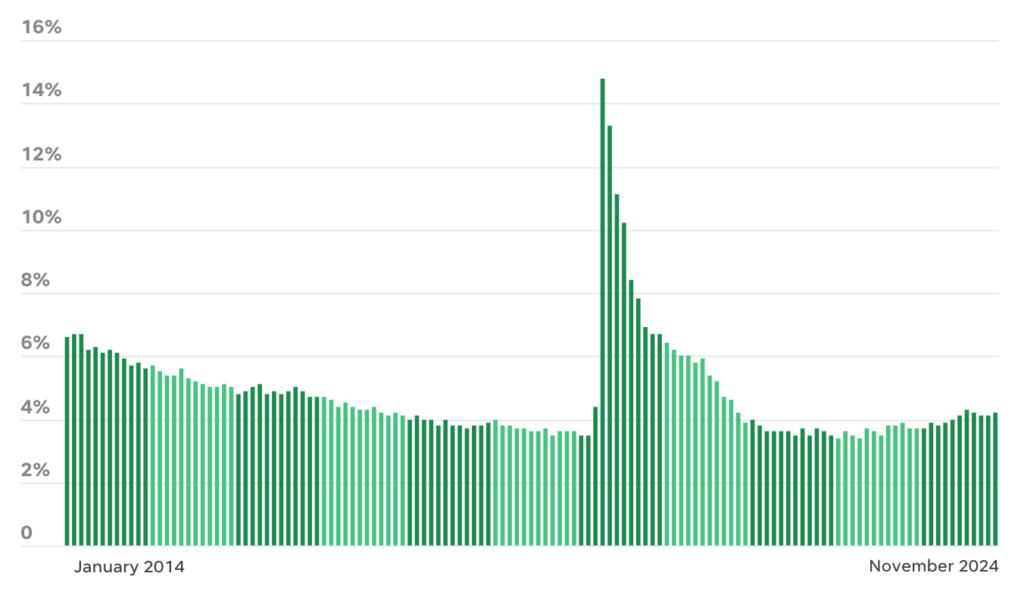

Inflation and Interest Rates

Inflation has been a concern, though it is showing signs of easing. The Consumer Price Index (CPI) inflation fell below 3.0% in July 2024 and is expected to continue decreasing, hitting 2.7% by the fourth quarter of 2024. The Federal Reserve is anticipated to begin cutting interest rates, with a target rate expected to fall by 100 basis points in 2024 and another 100 basis points in 2025.

Labor Market

The labor market remains healthy but is showing signs of slowing. Payroll growth has trended lower, with an average of 116,000 new nonfarm payroll jobs per month over the past three months, according to S&P Global Ratings. The unemployment rate has risen to its highest level since October 2021, but it is still within manageable limits.

Geopolitical and Trade Risks

Geopolitical conflicts and trade policy issues pose significant risks to the US economy. Deloitte highlights that these risks could combine to yield persistent inflation and impact economic growth.

Expert Opinions

Several experts have weighed in on the debate.

Valentina Romei’s Analysis

Valentina Romei’s Big Read notes that the US productivity boom is a significant factor in its economic success. US labor productivity has grown substantially more than in other advanced economies, contributing to the country’s economic strength.

Mario Draghi’s Insights

Mario Draghi points out the US’s leading role in tech innovation, particularly in the digital economy, which sets it apart from European counterparts. This innovation drive has been crucial in sustaining the US economic edge.

Martin Wolf’s Perspective

Martin Wolf argues that while the US economy stands out for its prosperity, it also faces significant social and economic challenges. High homicide and incarceration rates, surprisingly high child mortality, and low life expectancy are among the issues that temper the narrative of US economic exceptionalism.

Ruchir Sharma’s Warning

Ruchir Sharma suggests that the faith in the US economy might be misplaced and that it is over-owned, overvalued, and overhyped. He compares this to past financial bubbles, warning of potential risks and instability.

Conclusion

The debate on whether the US economy is exceptional or overhyped is complex and multifaceted. While the economy has shown remarkable growth and resilience, driven by strong consumer spending, business investment, and productivity gains, it also faces significant challenges such as inflation, labor market slowdowns, and geopolitical risks.

Future Outlook

Looking ahead, the US economy is expected to continue growing, though at a more moderate pace. Real GDP growth is forecasted to average around 2.5% in 2024 and slow to around 1.8% in 2025, according to S&P Global Ratings and Deloitte. The Federal Reserve’s anticipated interest rate cuts and the ongoing impact of the Inflation Reduction Act and CHIPS Act are expected to support continued growth in consumer spending and business investment.

In conclusion, while the US economy has many strengths that justify its exceptional status, it is crucial to acknowledge and address the underlying risks and challenges to ensure sustainable growth.

FAQ Section

1. What is the current state of the US economy?

The US economy has shown significant growth, with a projected GDP increase of around 2.7% in 2024. Key drivers include consumer spending, business investment, and rising productivity. However, challenges such as inflation and geopolitical risks remain.

2. How does consumer spending impact the US economy?

Consumer spending accounts for approximately 70-80% of the US GDP, making it a crucial component of economic growth. Increased consumer spending typically drives business revenues, leading to higher investment and job creation.

3. What are the main risks facing the US economy?

The US economy faces several risks, including inflationary pressures, potential interest rate hikes by the Federal Reserve, geopolitical conflicts, and trade policy uncertainties that could impact economic stability.

4. What role does productivity play in economic growth?

Increased productivity allows for more output without a corresponding increase in input costs, leading to economic growth. The US has experienced a significant boost in productivity, contributing to its economic success compared to other advanced economies.

5. How can I stay updated on US economic forecasts?

You can stay informed by following reputable financial news sources, subscribing to economic reports from organizations like the Conference Board, Simon-Kucher & Partners, and S&P Global, and using financial analysis platforms.

Additional Resources

Here are some resources related to your article that can provide your audience with more in-depth information:

- S&P Global – Economic Outlook

S&P Global Economic Outlook

Comprehensive reports on economic forecasts and trends in the US economy. - Deloitte – US Economic Forecast

Deloitte Economic Forecast

Insightful analysis and projections for the US economy, including growth drivers and potential risks. - The Conference Board

The Conference Board

Provides research and insights on economic trends, consumer confidence, and business conditions. - Federal Reserve Economic Data (FRED)

FRED Economic Data

A comprehensive database of economic data and information from the Federal Reserve Bank of St. Louis. - World Bank – US Economic Profile

World Bank: United States Economic Profile

Offers detailed economic analysis and statistics related to the US economy. - International Monetary Fund (IMF) – United States

IMF United States

Contains reports and data on the US economy, including growth forecasts and policy recommendations. - Wall Street Journal – Economic Insights

Wall Street Journal

A leading source for news and analysis on the US and global economy.